Introduction

What if your money kept showing up even on the days you didn’t feel like working?

That question is usually where the curiosity around passive income ideas begins. For most people, it starts with exhaustion. Long hours. One paycheck. Little room for error. Maybe you’ve had that moment—staring at your bank app, realizing your time is completely tied to your income, and wondering if there’s another way.

Passive income isn’t about quitting your job overnight or chasing “get-rich-quick” schemes. It’s about building systems that continue to generate income after the initial work is done. Some require upfront effort, some require capital, and most require patience. But when done right, they create breathing room—financially and mentally.

In this guide, you’ll learn what passive income really looks like in the real world, which passive income ideas actually work today, how to choose the right ones for your situation, and how to avoid the common traps that keep people stuck. Whether you’re starting with $0 or a solid savings cushion, this article is designed to help you move from curiosity to clarity.

What Passive Income Really Means (And What It Doesn’t)

Passive income is often misunderstood, mostly because social media has turned it into a fantasy. In reality, passive income is less like a magic faucet and more like a well-designed irrigation system. You build it carefully, maintain it occasionally, and over time it keeps delivering results.

At its core, passive income is money earned with minimal ongoing effort after the initial setup. That doesn’t mean “no work.” It means front-loading the work instead of trading hours for dollars forever.

Think of it this way:

Active income is like getting paid to carry buckets of water every day.

Passive income is building a pipeline that delivers water automatically.

Examples help make this clearer. Writing an ebook once and selling it repeatedly is passive. Buying a rental property and collecting rent monthly is semi-passive. Creating a YouTube channel that earns ad revenue long after videos are published is passive with maintenance.

What passive income is not:

- Overnight wealth with zero effort

- Guaranteed returns with no risk

- A replacement for all work immediately

The most sustainable passive income ideas live somewhere between effort and automation. They reward consistency, learning, and realistic expectations—especially in the first year.

Why Passive Income Ideas Matter More Than Ever

The traditional “one job, one paycheck” model is fragile. Layoffs happen. Industries shift. Inflation quietly eats purchasing power. Passive income provides resilience.

One of the biggest benefits is optionality. When you’re not fully dependent on a single income source, your decisions change. You negotiate better. You walk away from toxic work environments. You invest in skills instead of scrambling to survive.

Passive income ideas are especially powerful for:

- Full-time employees wanting financial backup

- Freelancers and creators seeking income stability

- Parents needing flexible earning options

- Retirees or near-retirees looking for supplemental income

- Entrepreneurs diversifying revenue streams

Real-world scenarios make this tangible. A teacher builds a small digital course that brings in $600 a month. A graphic designer sells templates that consistently earn on autopilot. A couple invests in dividend stocks that cover their utility bills.

None of these stories start glamorous. They start with curiosity, small experiments, and patience.

Categories of Passive Income Ideas (So You Choose the Right Ones)

Not all passive income ideas are created equal, and choosing the wrong category for your situation is one of the biggest reasons people quit early. A helpful way to think about passive income is by grouping ideas into buckets based on time, money, and skills.

The first category is capital-based passive income. These require money upfront but minimal time once set up. Examples include dividend-paying stocks, bonds, high-yield savings accounts, and real estate investments. If you have capital but limited time, this category often makes the most sense.

The second category is skill-based passive income. These require time and expertise upfront but little to no money. Digital products, online courses, affiliate content, and intellectual property fall here. If you’re starting with more skills than cash, this is usually the smartest path.

The third category is hybrid passive income. These sit in the middle—requiring both time and money but offering scalable returns. Rental properties, automated ecommerce stores, and software-as-a-service products fit here.

Understanding which category aligns with your current life situation prevents frustration and unrealistic expectations.

4

High-Quality Passive Income Ideas That Actually Work

Digital Products and Intellectual Assets

Digital products are one of the most accessible passive income ideas today. Once created, they can be sold repeatedly with near-zero delivery costs. Examples include ebooks, templates, stock photos, design assets, spreadsheets, and educational resources.

What makes this approach powerful is leverage. You solve a problem once and get paid many times. A photographer might sell Lightroom presets. A finance professional could sell budgeting templates. A writer might publish a niche guide that answers a specific pain point.

The key is usefulness, not perfection. The best-selling digital products are often simple, focused, and practical. They don’t try to solve everything—just one clear problem for one specific audience.

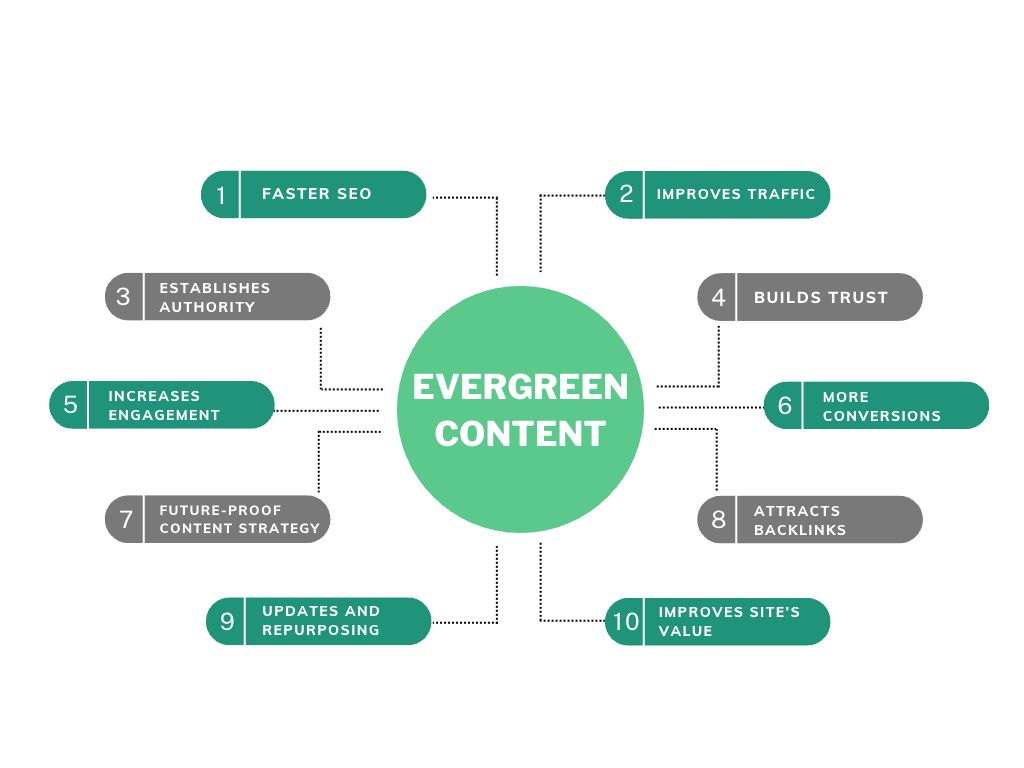

Affiliate Content and Evergreen Media

Affiliate income becomes passive when the content itself is evergreen. Blog posts, YouTube videos, and email sequences can all generate commissions long after they’re created.

This model works best when trust is the foundation. Recommending tools you actually use and understand leads to higher conversions and long-term credibility. Many creators build entire income streams by answering common questions and linking to helpful solutions.

The compounding effect is real. One well-optimized article can earn for years with occasional updates.

Dividend Investing and Automated Portfolios

Dividend-paying investments are among the most traditional passive income ideas. You invest capital, and companies pay you a portion of profits regularly.

This approach shines when paired with long-term thinking. Reinvesting dividends accelerates growth through compounding. Over time, even modest monthly dividends can turn into meaningful income.

Automated investing platforms make this easier than ever, especially for beginners who don’t want to manage individual stocks.

Rental Income and Real Estate Alternatives

Real estate is often labeled passive, but it’s more accurately semi-passive. That said, when systems are in place—property managers, automated payments, maintenance workflows—it can generate consistent cash flow.

For those who don’t want to own physical property, real estate investment trusts (REITs) offer exposure without hands-on involvement.

Step-by-Step Guide to Building Your First Passive Income Stream

Step one is choosing one idea, not five. Spreading yourself too thin kills momentum. Pick the idea that best matches your current resources.

Step two is validating demand. Before building anything, confirm that people are already paying for similar solutions. Look at marketplaces, search results, and forums. Demand beats originality every time.

Step three is building the minimum viable version. Your first digital product doesn’t need to be perfect. It needs to be useful. Your first blog post doesn’t need to go viral. It needs to rank and help.

Step four is automating distribution. This is where passive income is born. Email sequences, checkout systems, and scheduled content turn effort into leverage.

Step five is optimizing, not reinventing. Small improvements—better headlines, clearer calls-to-action, updated content—often produce outsized gains.

Consistency matters more than brilliance at this stage.

4

Tools, Platforms, and Smart Recommendations

The right tools don’t create passive income, but they remove friction. Choosing reliable platforms saves time and prevents burnout.

For digital products and courses, platforms like Gumroad and Podia are popular because they handle payments, delivery, and basic automation. Gumroad is simple and creator-friendly, while Podia offers more customization and email tools.

For affiliate marketing and content-driven income, a solid website matters. Hosting providers like SiteGround are known for reliability and beginner-friendly support.

For investing-based passive income, automated platforms such as Vanguard or Fidelity help simplify long-term strategies.

Free tools are great for starting, but paid tools often pay for themselves once income begins. The key is avoiding tool overload. Start lean. Upgrade intentionally.

Common Passive Income Mistakes (And How to Fix Them)

One of the most common mistakes is expecting passive income to be fast. Most streams take months, not weeks, to gain traction. The fix is setting realistic timelines and measuring progress correctly.

Another mistake is building before understanding the audience. Creating something nobody wants is discouraging and avoidable. The fix is market research—reading reviews, comments, and questions before building.

Many people also quit too early. Passive income compounds slowly at first, then suddenly. The fix is committing to a minimum timeframe—often six to twelve months—before evaluating results.

Lastly, over-automation too early can backfire. Systems should support value, not replace it. The fix is focusing on usefulness first, automation second.

Conclusion: Passive Income Is Built, Not Found

The most reliable passive income ideas aren’t secrets. They’re systems built patiently by people who understand leverage, consistency, and value creation.

Whether you start with a digital product, an investment portfolio, or a piece of evergreen content, the path is the same: learn, build, optimize, repeat. Passive income doesn’t eliminate work—it transforms it. You trade constant effort for intentional effort.

If there’s one takeaway, it’s this: start small, but start now. One well-built income stream can change how you work, save, and live.

FAQs

What is the easiest passive income idea for beginners

Digital products and affiliate content are often the easiest because they require little upfront capital and scale well with skills.

Can passive income replace a full-time job

Yes, but usually over time. Most people build passive income alongside active income first.

How much money do I need to start

Some ideas require money, others require time. Many skill-based passive income ideas can start with $0.

Is passive income really passive

Most streams are semi-passive. They require occasional updates, optimization, and maintenance.

How long does passive income take to work

Anywhere from a few months to a year, depending on the model and effort.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.