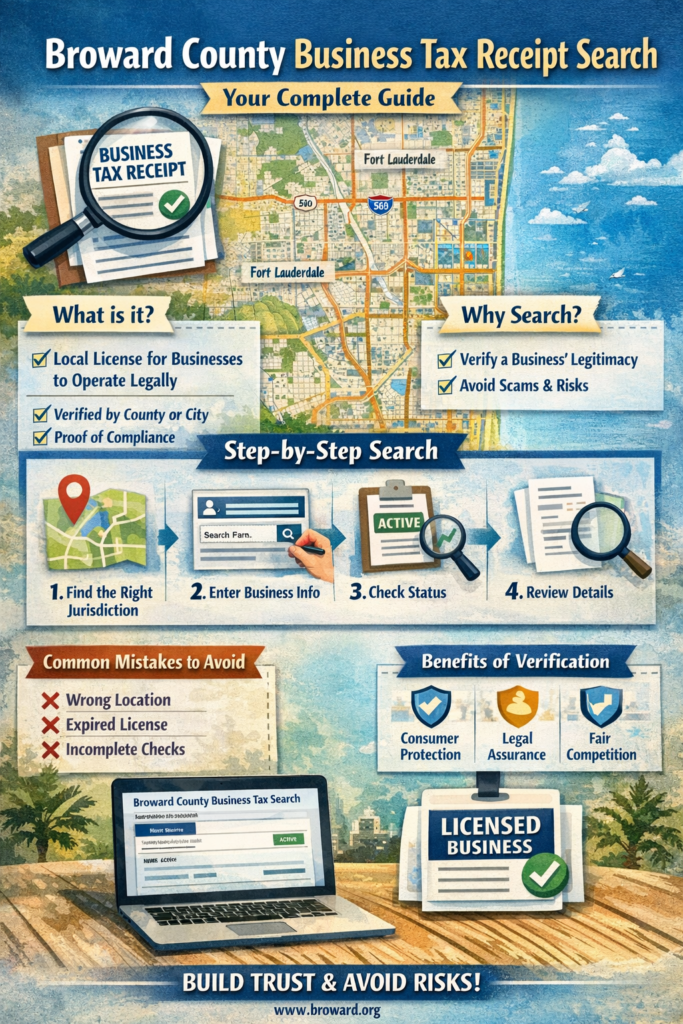

If you’ve ever tried to verify whether a business in Florida is legally operating, chances are you’ve come across the term broward county business tax receipt search. Maybe you were hiring a contractor, opening your own shop, or simply trying to confirm a company’s legitimacy before paying an invoice. Whatever brought you here, one thing is certain: understanding how this system works can save you time, money, and serious headaches.

Local licensing rules aren’t the most exciting topic in the world, but they quietly protect consumers, ensure fair competition, and keep communities running smoothly. In Broward County, a business tax receipt is more than a piece of paper—it’s proof that a business is registered, compliant, and authorized to operate in a specific location.

This guide breaks everything down in plain language. You’ll learn what a Broward County business tax receipt actually is, why it matters, how to search for one step by step, the best tools to use, common mistakes to avoid, and practical tips drawn from real-world experience. By the end, you’ll feel confident navigating the process whether you’re a business owner, freelancer, landlord, or cautious customer.

What a Broward County business tax receipt really means

A Broward County business tax receipt is essentially a local operating license issued by the county or municipality confirming that a business has registered, paid required local taxes or fees, and meets zoning and regulatory requirements. Think of it like a “permission slip” from the local government that says, “Yes, this business can legally operate here.”

Many people confuse this with a state business license or federal registration, but it’s different. In Florida, the state often regulates professions while counties and cities regulate the right to operate at a specific location. That’s why a contractor might hold a state certification yet still need a county business tax receipt to work legally within Broward County.

Here’s a simple analogy. Imagine driving a car:

- Your driver’s license = state professional license

- Your car registration = business registration with the state

- Your parking permit for a neighborhood = local business tax receipt

All three serve different purposes, but you need each one to avoid trouble.

The search system allows anyone—customers, vendors, landlords, or competitors—to confirm whether a business has this local authorization. Transparency like this builds trust in the local economy and reduces fraud.

Why people perform a Broward County business tax receipt search

Most searches happen for practical, real-world reasons rather than curiosity. People want reassurance before making financial decisions, signing contracts, or starting new ventures.

Consumers often search before hiring:

- Home repair contractors

- Cleaning services

- Landscapers

- Mobile vendors

- Freelancers operating from home

Business owners search when:

- Checking competitors’ legitimacy

- Verifying subcontractors

- Confirming compliance before partnerships

- Preparing due diligence for acquisitions

Landlords and property managers search to ensure:

- Tenants aren’t running illegal businesses

- Zoning rules are followed

- Liability risks are minimized

Even government agencies and banks rely on these records for compliance checks and documentation.

At its core, the search is about risk reduction. Spending five minutes verifying a receipt can prevent months of legal or financial trouble later.

Key benefits of using the official search system

The broward county business tax receipt search tool offers several powerful advantages that many people underestimate until they actually need them.

First, it provides instant verification. Instead of trusting marketing claims or verbal assurances, you get confirmation directly from government records. That level of reliability matters when money or safety is involved.

Second, it improves consumer protection. Licensed businesses are more likely to follow regulations, maintain insurance, and meet safety standards. While a receipt isn’t a guarantee of quality, it’s a strong baseline indicator of legitimacy.

Third, it supports fair competition. Legitimate businesses invest time and money into compliance. When unlicensed operators undercut prices, everyone loses—including customers who may receive poor service.

Fourth, it helps with legal documentation. In disputes, proof that a business lacked proper authorization can become important evidence.

Finally, it enables smarter decision-making. Whether you’re hiring, partnering, investing, or renting property, verified information leads to better outcomes.

Step-by-step guide to performing a Broward County business tax receipt search

Let’s walk through the exact process in a clear, practical way. Even if you’ve never used a government database before, this will feel straightforward.

Step 1: Identify the correct jurisdiction

Broward County includes multiple cities such as Fort Lauderdale, Hollywood, Pembroke Pines, and others. Some business tax receipts are issued by the county, while others are issued by individual municipalities.

Start by determining:

- Where the business is physically located

- Whether the area is incorporated (city) or unincorporated (county)

Searching the wrong jurisdiction is one of the most common mistakes, so this step matters.

Step 2: Access the official search portal

Go to the relevant county or city website and locate the business tax receipt search page. Look for terms like:

- Business tax receipt lookup

- Local business license search

- Contractor or occupational license search

Always use official government websites to avoid outdated or inaccurate third-party data.

Step 3: Enter available business details

Most systems allow searches using:

- Business name

- Owner name

- Address

- Receipt number

If you’re unsure of spelling, try partial names. Databases often return broader matches that you can narrow down.

Step 4: Review the search results carefully

A valid record typically shows:

- Business name and owner

- Physical address

- Receipt status (active, expired, pending)

- Issue and expiration dates

- Business category or activity

Pay close attention to expiration dates. A business may have been licensed in the past but is no longer compliant.

Step 5: Confirm additional licensing if needed

Some professions also require:

- State licenses

- Insurance certificates

- Permits or inspections

Use the local receipt as one layer of verification, not the only one.

Tools and resources that make the process easier

While official government portals should always be your primary source, a few additional tools can simplify research and verification.

Public records aggregators sometimes compile licensing data from multiple jurisdictions into one searchable interface. These can save time when checking businesses across different cities, though accuracy varies.

Professional licensing boards provide state-level verification for regulated occupations like contractors, cosmetologists, and real estate agents. Cross-checking local and state records gives a fuller compliance picture.

Mapping tools help confirm whether an address falls within city limits or unincorporated county territory—useful when you’re unsure where to search.

Free options usually provide basic verification, while paid compliance platforms may offer monitoring alerts, document storage, or bulk searches for property managers and corporations.

The best approach is a hybrid method:

- Start with the official local database

- Cross-check state licensing

- Use aggregators only for convenience, not final proof

Common mistakes people make during a business tax receipt search

Even simple searches can go wrong if you don’t know what to watch for. Here are the most frequent errors and how to avoid them.

Searching the wrong city or county database is the number one issue. Always confirm jurisdiction first.

Assuming an expired receipt is still valid can lead to hiring non-compliant businesses. Check status dates carefully.

Confusing similar business names may cause false assumptions. Compare addresses and owner names to be sure.

Relying solely on third-party websites risks outdated data. Government sources should always be the final authority.

Ignoring state licensing requirements leaves gaps in verification, especially for regulated trades.

Fixing these mistakes is straightforward:

- Double-check jurisdiction

- Verify expiration dates

- Match multiple identifiers

- Use official sources

- Cross-reference state records

Real-world scenarios where verification matters most

Understanding theory is helpful, but real situations show why this search truly matters.

Imagine hiring a contractor for a major home renovation. Midway through the project, problems arise and the contractor disappears. Without proper licensing, legal recovery becomes far more difficult.

Or consider renting commercial property to a tenant running an unauthorized business. Zoning violations could result in fines or forced closure affecting both landlord and tenant.

Even small service hires—like cleaning or landscaping—carry liability risks if workers lack proper authorization or insurance.

In each case, a quick broward county business tax receipt search beforehand could prevent costly consequences.

Best practices for business owners applying for or maintaining compliance

If you operate a business in Broward County, staying compliant isn’t just about avoiding penalties—it’s about building trust and credibility.

Keep renewal dates on your calendar to prevent accidental expiration.

Ensure your business address matches zoning rules and lease agreements.

Display your receipt visibly if required, reinforcing professionalism.

Maintain any related state licenses or insurance policies.

Update records promptly when ownership, name, or location changes.

Compliance isn’t bureaucracy—it’s reputation management.

Conclusion: why this simple search carries real power

At first glance, the broward county business tax receipt search might seem like just another government database. But in practice, it’s a powerful transparency tool protecting consumers, supporting honest businesses, and strengthening the local economy.

Whether you’re hiring a contractor, launching a startup, screening tenants, or performing due diligence, taking a few minutes to verify licensing can prevent serious problems later.

Think of it as a small habit with big impact—one quick search that adds confidence to every business decision you make.

If this guide helped you understand the process, consider bookmarking it, sharing it with others, or exploring related compliance topics that keep your business and finances secure.

FAQs

What is a Broward County business tax receipt?

It’s a local authorization confirming a business has registered, paid required local fees, and is allowed to operate at a specific location within Broward County or its cities.

Is a business tax receipt the same as a business license?

Not exactly. It’s a local operating license, while state or federal licenses regulate professions or taxation separately.

Can I search for a business tax receipt online?

Yes. Most Broward County jurisdictions provide official online databases for public verification.

What if a business doesn’t appear in the search results?

It may be unlicensed, expired, registered in another city, or listed under a different name. Further verification is recommended.

Do home-based businesses need a receipt?

In many cases, yes—especially if operating regularly or generating income within the county.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.