Introduction

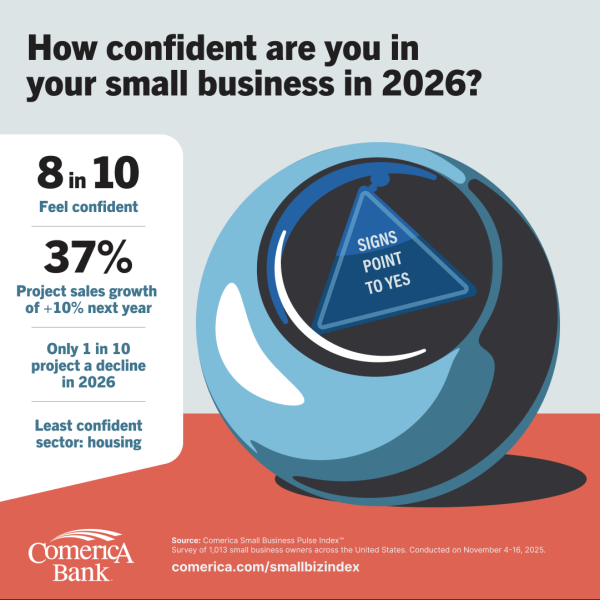

If you’ve ever tried to get a business loan, you already know the feeling. You sit across from a lender (or stare at a screen), confident in your idea, only to be met with jargon, fine print, and rejection emails that explain nothing. For many entrepreneurs, funding isn’t just a financial hurdle — it’s an emotional one. That’s why platforms like traceloans.com business loans have started gaining attention among small business owners looking for clearer, faster, and more accessible financing options.

In today’s economy, cash flow can make or break a business. Whether you’re launching a startup, expanding operations, covering payroll, or simply bridging a slow season, access to capital matters more than ever. Traditional banks still serve a purpose, but they aren’t always built for speed or flexibility. That gap is where alternative lending platforms step in.

This guide breaks down everything you need to know about traceloans.com business loans — what it is, how it works, who it’s best for, and how to use it smartly. We’ll cover benefits, step-by-step application insights, common mistakes to avoid, and real-world use cases so you can make an informed decision instead of a desperate one.

If you want clarity without hype, and guidance that feels like it came from someone who’s actually been through the process, you’re in the right place.

Understanding traceloans.com business loans (Explained Simply)

At its core, traceloans.com business loans is about simplifying access to business funding. Instead of acting like a traditional bank that lends its own money, the platform functions more like a connector — matching business owners with loan options based on their profile, needs, and eligibility.

Think of it like a financial matchmaking service. Rather than visiting multiple lenders, filling out repetitive applications, and hoping something sticks, traceloans.com centralizes the process. You provide your business details once, and the system helps surface potential loan solutions that align with your situation.

This approach is especially appealing for small businesses that don’t fit the “perfect borrower” mold. Many entrepreneurs are profitable but lack long credit histories, spotless financials, or years of operation. Traditional banks often reject these applicants automatically. Platforms like traceloans.com focus more on overall viability than rigid checklists.

What makes this model practical is accessibility. You’re not locked into a single lender or loan type. Depending on your profile, you may be guided toward:

- Short-term working capital loans

- Equipment financing

- Merchant cash advances

- Business lines of credit

- Startup or near-startup funding options

The platform is designed for speed and clarity, not complexity. While it doesn’t remove the responsibility of borrowing wisely, it does reduce friction, confusion, and wasted time — three things business owners have very little of.

Benefits and Real-World Use Cases of traceloans.com business loans

The biggest advantage of traceloans.com business loans isn’t just access to money — it’s access to options. In the real world, businesses don’t fail because they lack ideas; they fail because timing and cash flow don’t align. Having flexible funding at the right moment can change everything.

One major benefit is speed. Traditional loans can take weeks or even months. For a business dealing with urgent inventory needs or unexpected expenses, that timeline simply doesn’t work. Platforms like traceloans.com often connect borrowers with faster-moving lenders, sometimes delivering decisions in days instead of weeks.

Another benefit is inclusivity. Many business owners assume they won’t qualify for funding due to average credit, limited operating history, or inconsistent revenue. While no platform guarantees approval, traceloans.com business loans often cater to lenders willing to evaluate the bigger picture instead of just a credit score.

Common real-world use cases include:

- A retail store preparing for a high-demand season but lacking upfront inventory cash

- A service-based business covering payroll while waiting on delayed client payments

- A restaurant upgrading kitchen equipment to increase efficiency

- A freelancer or consultant formalizing operations into a registered business

What stands out is flexibility. Rather than forcing one rigid loan structure, the platform helps surface funding that aligns with how your business actually operates. That adaptability can reduce financial strain and make repayment more manageable.

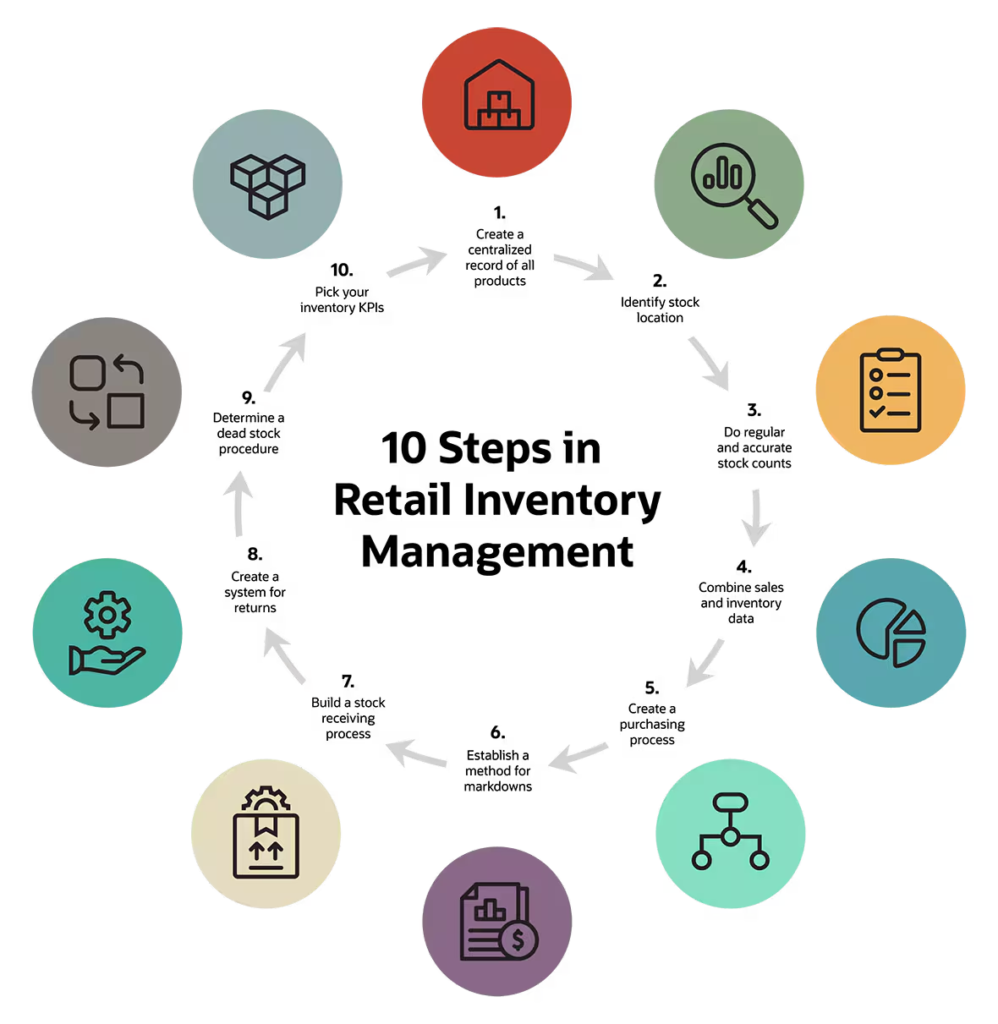

Step-by-Step Guide: How traceloans.com business loans Work

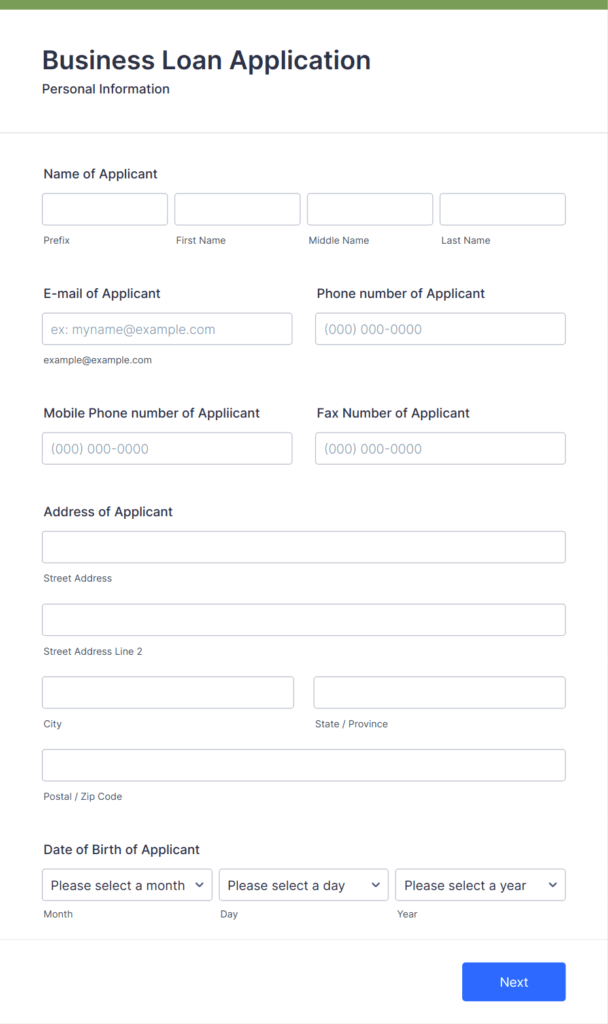

Understanding the process before applying can save you time, stress, and costly mistakes. While exact steps may vary, the general flow for traceloans.com business loans is straightforward and beginner-friendly.

First, you start with a basic application. This usually includes information about your business type, time in operation, estimated revenue, and funding needs. Unlike traditional banks, this initial step is often quick and doesn’t require exhaustive documentation upfront.

Next comes the matching phase. Based on your details, the platform evaluates potential lenders or loan structures that fit your profile. This is where traceloans.com adds value — instead of blindly applying everywhere, you’re guided toward more realistic options.

Once matched, you may be asked for supporting documents. These can include bank statements, proof of business registration, or identification. The key is honesty. Inflating numbers or hiding issues almost always backfires later.

After review, you receive loan offers. This is the most important step — and where many borrowers rush. Take time to evaluate:

- Interest rates or factor rates

- Repayment schedules

- Fees or penalties

- Total cost over time

Finally, if you accept an offer, funds are disbursed according to the lender’s timeline. From start to finish, the process is designed to minimize friction while still protecting both sides of the transaction.

Tools, Comparisons, and Smart Recommendations

When evaluating traceloans.com business loans, it helps to compare it with other funding paths. Traditional banks offer lower rates but stricter requirements and slower approvals. Online lenders move fast but can be expensive. Peer-to-peer platforms vary widely in quality and transparency.

What sets traceloans.com apart is its aggregator-style approach. Instead of forcing a one-size-fits-all solution, it exposes borrowers to multiple possibilities. This is particularly useful if you’re unsure which loan type fits your needs.

Free tools typically include pre-qualification checks and basic comparisons. Paid or premium options may offer deeper guidance, priority processing, or specialized lender access. Whether paid features are worth it depends on urgency and loan size.

Expert recommendations include:

- Always compare total repayment cost, not just monthly payments

- Avoid loans that strain daily cash flow

- Match loan length to the purpose (short-term needs shouldn’t use long-term debt)

- Read lender reviews, not just platform claims

The smartest borrowers treat funding like a tool, not a lifeline. traceloans.com business loans can be valuable — when used strategically.

Common Mistakes Business Owners Make (And How to Fix Them)

One of the most common mistakes is borrowing without a clear plan. Money solves problems, but it also magnifies them if misused. Before applying through traceloans.com business loans, define exactly how the funds will generate returns or stability.

Another mistake is focusing only on approval, not affordability. Getting approved feels like a win — until repayments start squeezing your operations. Always model worst-case scenarios and ensure your business can handle repayments during slow periods.

Documentation errors also cause delays or rejections. Inconsistent bank statements, unclear revenue reporting, or missing licenses can raise red flags. Preparation matters more than perfection.

Finally, many borrowers ignore fine print. Fees, early repayment penalties, and variable terms can change the true cost of a loan. Slow down, read carefully, and ask questions before committing.

Fixing these mistakes starts with patience and education. The more informed you are, the more leverage you have.

Conclusion: Is traceloans.com business loans Worth It?

For many small business owners, traceloans.com business loans represents a practical alternative to rigid banking systems. It doesn’t promise miracles — and that’s a good thing. Instead, it offers access, transparency, and choice in a space that’s often confusing and intimidating.

If you value speed, flexibility, and multiple funding options in one place, the platform can be a strong starting point. Like any financial tool, its value depends on how thoughtfully you use it. Borrow with intention, evaluate offers carefully, and align funding with real business goals.

If you’ve used traceloans.com before or are considering it now, take the time to explore your options fully. Smart funding decisions today can shape your business for years to come.

FAQs

What is traceloans.com business loans used for?

It helps connect business owners with potential loan options based on their financial profile and needs.

Is traceloans.com a direct lender?

No, it typically acts as a platform that matches borrowers with lenders rather than lending directly.

Can startups apply for traceloans.com business loans?

Some options may be available for newer businesses, depending on revenue and eligibility.

Does applying affect credit score?

Initial pre-qualification usually doesn’t, but finalized applications may involve credit checks.

How fast can funds be received?

Timelines vary by lender, but many offers are faster than traditional bank loans.

Are there alternatives to traceloans.com business loans?

Yes, including banks, online lenders, and peer-to-peer platforms, each with different pros and cons.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.