Introduction

If you’ve ever read a will or beneficiary designation and felt your eyes glaze over at the Latin phrases, you’re not alone. Estate planning documents are full of terms that sound intimidating but often describe very practical ideas. One of the most common—and most misunderstood—is per stirpes meaning.

Imagine this situation: a parent writes a will leaving assets “to my children, per stirpes.” Years later, one child passes away before the parent, leaving children of their own. Who gets what? Do the grandchildren receive anything? Does the surviving child inherit everything? The answer depends almost entirely on whether the will uses per stirpes or a different distribution method.

This topic matters because beneficiary wording can dramatically change how money, property, and family heirlooms are divided. A single phrase can mean the difference between a fair, predictable outcome and years of confusion—or even legal disputes. In this guide, you’ll learn exactly what per stirpes means, how it works in real life, when it makes sense to use it, and how to avoid common mistakes. By the end, you’ll be able to read a will or beneficiary form with confidence and make smarter estate planning decisions for your own family.

What Does Per Stirpes Mean? A Beginner-Friendly Explanation

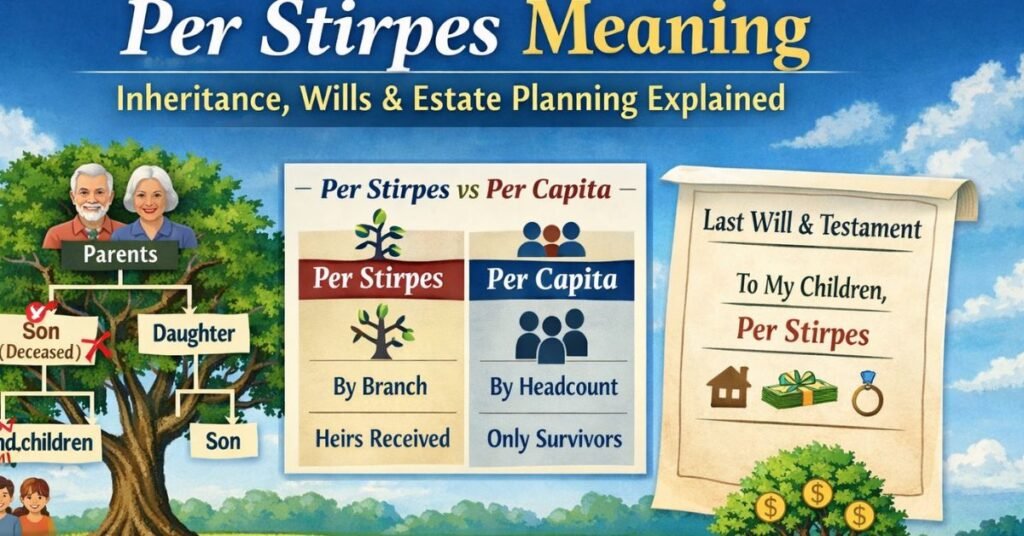

At its core, per stirpes meaning comes down to one simple idea: inheritance follows family branches. The Latin phrase per stirpes literally translates to “by roots” or “by branch.” Think of your family as a tree. Each child of the person who made the will represents a branch. If a branch is missing because that child has passed away, the inheritance flows down that branch to the next generation.

Here’s a plain-language version: with per stirpes distribution, each child of the deceased person gets an equal share. If one of those children has already died, their share doesn’t disappear—it goes to their children instead.

A quick example makes this clearer. Suppose Maria has three children: Alex, Brianna, and Carlos. Her will leaves everything to her children per stirpes. When Maria dies, Alex and Brianna are alive, but Carlos passed away years earlier and left two children. Under per stirpes, Maria’s estate is divided into three equal shares. Alex gets one-third. Brianna gets one-third. Carlos’s one-third is split equally between his two children.

The key takeaway is that per stirpes protects the inheritance rights of descendants. It ensures that each family line is treated fairly, even when someone dies earlier than expected. This is why per stirpes is so common in wills, trusts, and retirement account beneficiary designations.

Why Per Stirpes Matters in Real Life

Understanding per stirpes meaning isn’t just academic—it has very real consequences for families. Inheritance situations often arise during emotionally difficult times, and unclear instructions can make things worse. Per stirpes provides a built-in roadmap for what happens when beneficiaries die before the person who created the estate plan.

One major reason per stirpes matters is predictability. Families are dynamic. Children may pass away early, grandchildren may be born, and relationships evolve. A per stirpes designation automatically adjusts to these changes without needing constant updates. That flexibility can be incredibly valuable if you don’t want to revise your estate plan every few years.

Another reason is fairness across generations. Many people want their assets to stay within their bloodline. Per stirpes ensures that a deceased child’s children are not unintentionally disinherited. Without it, surviving siblings could receive more than intended, while grandchildren receive nothing.

Finally, per stirpes can reduce conflict. Clear instructions leave less room for interpretation. When beneficiaries understand that distribution follows family branches, there’s less likelihood of arguments over who deserves what. In many cases, that clarity preserves family relationships long after the estate is settled.

Per Stirpes vs. Per Capita: Understanding the Difference

To truly understand per stirpes meaning, it helps to compare it with its most common alternative: per capita. These two approaches often lead to very different outcomes, even with the same family structure.

Per capita means “by the head” or “per person.” Under a per capita distribution, assets are divided equally among all surviving beneficiaries at a certain generation level. If someone in that generation has died, their share does not automatically pass to their children unless the document specifically says so.

Let’s revisit the earlier example. Maria has three children: Alex, Brianna, and Carlos. Carlos has two children. If Maria’s will used per capita instead of per stirpes, the estate would likely be divided only among the surviving children—Alex and Brianna. Each would receive half. Carlos’s children would receive nothing unless the will explicitly included them.

This difference is why per stirpes is often preferred by people who want to protect grandchildren and future generations. Per capita, on the other hand, can make sense when someone wants to focus solely on the surviving beneficiaries at a specific level, such as adult children only.

Understanding which method applies is crucial. Many disputes arise because beneficiaries assume one method applies when the document actually specifies the other.

Who Should Use Per Stirpes Distribution?

Per stirpes distribution is not a one-size-fits-all solution, but it is particularly well-suited for certain family situations. If you have children and grandchildren, it’s often a strong default option.

Parents with multiple generations to consider are prime candidates. If your goal is to ensure that each child’s family line is treated equally, even if something happens to that child, per stirpes aligns perfectly with that intention. It provides peace of mind that your grandchildren will not be left out.

Blended families may also benefit from per stirpes, though with extra care. If you have children from previous relationships, per stirpes can ensure that each child’s descendants inherit their intended share. However, this should be coordinated carefully with spousal provisions to avoid unintended consequences.

Business owners sometimes choose per stirpes when passing down family businesses or shares. This ensures that ownership interests remain balanced across family branches, rather than concentrating in the hands of fewer heirs over time.

In short, per stirpes is best suited for people who value long-term family balance, generational fairness, and flexibility in the face of life’s uncertainties.

How Per Stirpes Works Step by Step

Understanding per stirpes meaning becomes much easier when you walk through the process step by step. While the legal language can seem dense, the mechanics are straightforward.

First, identify the original beneficiaries. These are usually the children of the person who created the will or trust. Each child represents a primary branch.

Second, divide the estate into equal shares based on the number of original beneficiaries. If there are four children, the estate is divided into four equal portions, regardless of how many are alive.

Third, distribute shares to living beneficiaries. Any child who is alive at the time of distribution receives their full share directly.

Fourth, handle deceased beneficiaries. If a child has died before the person who created the estate plan, their share is passed down to their descendants. If they have multiple children, that share is divided equally among them.

Finally, repeat the process if necessary. If one of those descendants has also passed away, the share continues down that branch until it reaches living heirs.

This step-by-step structure is what makes per stirpes so powerful. It automatically adapts to complex family trees without requiring constant updates or revisions.

Using Per Stirpes in Wills, Trusts, and Beneficiary Forms

Per stirpes meaning applies across many different estate planning tools, but it’s especially common in wills, trusts, and beneficiary designations for financial accounts.

In wills, per stirpes language is often used in the section that distributes the “residuary estate,” or whatever remains after specific gifts are made. A typical phrase might read: “I leave the remainder of my estate to my children, per stirpes.” Those three words carry significant legal weight.

Trusts also use per stirpes to control how assets are distributed over time. For example, a trust might distribute income to children during their lifetimes, then pass the remaining principal to grandchildren per stirpes after all children have passed away.

Beneficiary forms for retirement accounts and life insurance policies frequently include a checkbox or dropdown for per stirpes. This is critical, because these accounts usually bypass the will entirely. If you forget to select per stirpes and a beneficiary dies, their share might go to unintended recipients or even into probate.

The key is consistency. Your will, trust, and beneficiary forms should all reflect the same distribution philosophy to avoid conflicts or confusion.

Benefits and Practical Use Cases of Per Stirpes

One of the biggest benefits of per stirpes is its ability to future-proof your estate plan. Life is unpredictable, and family structures change. Per stirpes automatically adjusts to births, deaths, and generational shifts without requiring constant updates.

Another advantage is fairness. Many people feel strongly that each child’s family line should receive an equal share, regardless of timing. Per stirpes honors that value by keeping distributions balanced across branches.

Per stirpes also simplifies decision-making. Instead of naming every potential descendant individually, you can rely on a clear framework that covers current and future generations. This reduces the risk of accidentally omitting someone.

Common use cases include parents with young grandchildren, grandparents planning for multi-generational wealth transfer, and anyone who wants to avoid unintentionally disinheriting descendants. In each scenario, per stirpes provides clarity, flexibility, and peace of mind.

Common Mistakes People Make with Per Stirpes (and How to Fix Them)

Despite its advantages, per stirpes is often misunderstood or misapplied. One common mistake is assuming per stirpes applies automatically. In reality, it must be explicitly stated. If your document doesn’t say per stirpes—or something equivalent—local laws or default rules may apply instead.

Another frequent error is mixing per stirpes with vague language. Phrases like “to my children and their heirs” can create ambiguity. Clear, specific wording is essential to ensure your intentions are followed.

People also forget to coordinate beneficiary forms with their will. Even if your will uses per stirpes, a retirement account without that designation may distribute assets differently.

The fix is simple but important: review all estate planning documents together, use consistent language, and consult a qualified professional when in doubt. Small wording changes can have a huge impact.

FAQs

What is the simplest definition of per stirpes?

Per stirpes means inheritance is divided by family branches, so a deceased beneficiary’s share passes to their descendants.

Does per stirpes include grandchildren?

Yes. If a child of the estate owner dies before them, that child’s share goes to their children under per stirpes.

Is per stirpes better than per capita?

Neither is universally better. Per stirpes is ideal for protecting descendants, while per capita focuses on equal distribution among surviving beneficiaries.

Does per stirpes apply automatically?

No. It must be specifically stated in a will, trust, or beneficiary designation.

Can per stirpes cause unequal payouts?

Yes, depending on family size. One branch with many descendants may receive the same total share as a branch with only one descendant.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.