If you’ve ever pulled your credit report and felt that sinking feeling in your stomach, you’re not alone. In credit repair Huntington Beach, this moment happens every single day to hardworking people who are doing their best but still feel stuck. Maybe you were denied a mortgage on a home near the coast. Maybe your car loan came back with an interest rate that made your jaw drop. Or maybe you’re simply tired of feeling judged by three digits that don’t reflect who you really are.

Credit matters—especially in a place like Huntington Beach, where the cost of living is high, competition for housing is intense, and lenders scrutinize every detail. The good news? Credit damage is rarely permanent. With the right strategy, patience, and guidance, you can improve your score and open doors you thought were closed.

In this in-depth guide, I’ll walk you through exactly how credit repair works in Huntington Beach, what your options are, what actually moves the needle, and how to avoid the traps that keep people stuck for years. This isn’t theory—it’s practical, experience-based advice designed to help you make real progress.

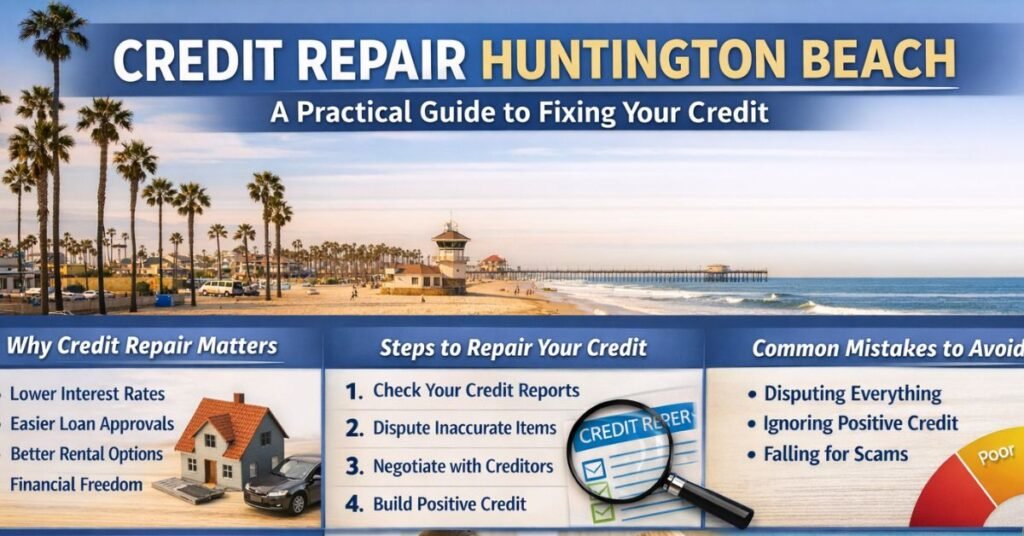

Understanding Credit Repair in Huntington Beach (Without the Confusion)

Credit repair Huntington Beach isn’t about “tricking” the system or magically erasing debt overnight. Think of your credit report like a long financial résumé. Over time, mistakes, misunderstandings, and tough seasons of life can leave negative marks. Credit repair is the process of reviewing that résumé line by line, challenging anything that’s inaccurate, outdated, or unfair, and building better habits moving forward.

At its core, credit repair involves:

- Reviewing your credit reports from all three bureaus

- Identifying errors, inconsistencies, or unverifiable accounts

- Disputing inaccurate items under federal law

- Negotiating or resolving legitimate negative accounts

- Establishing positive payment behavior going forward

In coastal cities like Huntington Beach, credit plays an outsized role in everyday life. Landlords often require higher scores, auto lenders price loans aggressively, and even some employers run credit checks. That means small improvements—20, 40, or 60 points—can have an outsized impact.

One of the biggest misconceptions I hear is that credit repair is only for people in serious trouble. In reality, many clients already have “okay” credit but want to optimize it. Others are rebuilding after medical bills, divorce, job loss, or a business setback. Credit repair isn’t about shame—it’s about accuracy, fairness, and strategy.

Why Credit Repair Matters So Much in Huntington Beach

The benefits of credit repair Huntington Beach go far beyond a higher number on a screen. When your credit improves, your entire financial life becomes easier and cheaper.

Here’s how better credit shows up in real life:

- Lower mortgage rates, which can save tens of thousands over time

- Easier approval for apartments and rental homes

- Lower auto loan interest rates and insurance premiums

- Better approval odds for business credit and personal loans

- Stronger negotiating power with lenders and creditors

In Huntington Beach specifically, competition is fierce. A landlord choosing between two applicants will almost always pick the one with stronger credit. A lender deciding between borderline files will price risk aggressively. Credit repair levels the playing field.

I’ve seen people go from feeling financially “stuck” to refinancing homes, leasing better vehicles, and qualifying for rewards cards within a year. Not because they became different people—but because their credit reports finally reflected the truth.

Credit repair is especially useful if:

- You’re planning to buy or refinance a home

- You want to lower interest rates before taking out a loan

- You’re self-employed and need strong credit access

- You’re rebuilding after financial hardship

When done correctly, credit repair isn’t a band-aid—it’s a reset.

Step-by-Step: How Credit Repair Actually Works

Let’s break down the credit repair Huntington Beach process in plain English. Whether you do it yourself or hire help, the steps are essentially the same.

Step 1: Pull and Review All Three Credit Reports

Start by getting reports from the three major bureaus: Experian, Equifax, and TransUnion. Look for:

- Accounts you don’t recognize

- Incorrect balances or payment histories

- Duplicate collections

- Accounts showing as late when they weren’t

Step 2: Identify Disputable Items

Not everything negative can be removed—but inaccuracies can. Common dispute targets include:

- Accounts not belonging to you

- Incorrect dates or balances

- Paid collections still showing unpaid

- Accounts that can’t be verified

Step 3: Send Strategic Disputes

Disputes must be clear, factual, and legally grounded. Credit bureaus are required to investigate and respond, typically within 30 days. Poorly written disputes waste time; strong disputes force verification.

Step 4: Address Legitimate Negatives

For accurate but negative items, the strategy shifts. This may involve:

- Negotiating pay-for-delete agreements

- Settling balances strategically

- Bringing accounts current

Step 5: Build Positive Credit

Repair alone isn’t enough. You also need:

- On-time payments

- Low credit utilization

- Healthy account mix

Credit repair is a process, not a single action. Most people see noticeable improvement within 3–6 months, with stronger results over 6–12 months.

DIY Credit Repair vs. Hiring a Local Huntington Beach Expert

One of the most common questions I hear is whether to handle credit repair Huntington Beach yourself or hire a professional. The honest answer: it depends on your situation, time, and tolerance for paperwork.

DIY Credit Repair

Pros:

- Free or very low cost

- Full control over the process

- Great learning experience

Cons:

- Time-consuming

- Easy to make mistakes

- Slower results for complex cases

DIY works best if you have minor errors and patience.

Professional Credit Repair Services

Pros:

- Experience with complex cases

- Structured dispute strategies

- Time-saving and stress-reducing

Cons:

- Monthly fees

- Need to vet providers carefully

Local professionals familiar with Huntington Beach lending and housing markets often understand what lenders here look for. The key is choosing a reputable company that follows the law and sets realistic expectations.

A good rule of thumb: if your credit issues are simple, DIY may work. If you’re facing multiple collections, charge-offs, or time pressure (like an upcoming home purchase), professional help can be worth it.

Tools, Resources, and Smart Recommendations

Effective credit repair Huntington Beach relies on the right tools. Here’s a practical breakdown.

Free Tools

- Annual credit report access

- Budgeting spreadsheets

- Credit monitoring apps

Best for awareness and education, but limited action.

Paid Tools & Services

- Credit monitoring with alerts

- Identity protection

- Professional dispute management

Pros:

- Convenience

- Faster detection of changes

- Guided strategies

Cons:

- Monthly costs

Expert Tip

Avoid any service promising “instant” results or guaranteed deletions. Credit repair is governed by law, and no one can override that.

If you do hire help, look for:

- Transparent pricing

- Month-to-month contracts

- Clear explanation of actions

Common Credit Repair Mistakes (and How to Fix Them)

Even smart people make avoidable mistakes during credit repair Huntington Beach. Here are the most common—and how to avoid them.

Mistake 1: Disputing Everything

Blanket disputes can backfire. Be precise and factual.

Fix: Only dispute items with legitimate inaccuracies.

Mistake 2: Ignoring Positive Credit Building

Removing negatives without adding positives limits progress.

Fix: Use secured cards or credit-builder loans responsibly.

Mistake 3: Closing Old Accounts Too Soon

This can shorten credit history and hurt scores.

Fix: Keep old, positive accounts open when possible.

Mistake 4: Falling for Scams

Promises of “new credit identities” or instant fixes are illegal.

Fix: Work only with compliant, transparent services.

Avoiding these mistakes can save months of frustration.

Conclusion: Credit Repair as a Long-Term Investment

Credit repair Huntington Beach isn’t about shortcuts—it’s about reclaiming control. Your credit report should tell an accurate story of who you are today, not who you were during a tough season years ago.

With the right approach, you can:

- Improve approval odds

- Lower interest rates

- Reduce financial stress

- Create real options for your future

Whether you tackle it yourself or partner with a trusted professional, the key is consistency and patience. Small steps, taken steadily, lead to meaningful change.

If you’re serious about improving your credit, start now. Review your reports, choose a strategy, and commit to the process. Your future self will thank you.

FAQs

How long does credit repair usually take?

Most people see improvements within 3–6 months, with continued progress over a year.

Is credit repair legal?

Yes. Federal law allows consumers to dispute inaccurate information.

Can all negative items be removed?

No. Only inaccurate, outdated, or unverifiable items can be removed.

Do I need a local Huntington Beach service?

Not required, but local experience can help with regional lending norms.

Will credit repair hurt my score?

Properly done, it typically helps—not hurts.Properly done, it typically helps—not hurts.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.